ME Foundation Initial Setup Transparency Report

Introduction

The ME Foundation, a Cayman Islands foundation company, was established to serve the ME DAO. The ME Foundation, governed by the ME DAO community, aims to promote the growth and development of the ME ecosystem while maintaining accountability to the community.

This document outlines the necessary actions taken before the DAO setup to comply with legal registration and operational requirements. The ME Foundation emphasizes the importance of transparency, detailing the actions and decisions made leading up to the DAO formation, especially for a project of this magnitude.

This document provides a clear summary of the activities so far, the structure of the ME DAO governed by $ME holders, and its governance powers over The ME Foundation.

The ME DAO can submit ME Improvement Proposals ("MIPs"), vote on them, and approve them through on-chain execution or actions of The ME Foundation. The rules and procedures of the MIP process are outlined in Section 1 and 2 of the ME DAO Constitution.

Through MIPs, in line with the ME DAO Constitution, the ME DAO can collectively make and implement changes ranging from core protocol technology to non-technical decisions affecting the community and $ME tokenholders.

Throughout this transparency report, we highlight where decisions made during the Foundation setup can be modified by an MIP and the process for doing so.

1. Foundation Governance: Directors

As a Cayman Islands foundation, the ME Foundation must have at least one director responsible for managing and operating the ME Foundation, including approving and entering into contractual arrangements. These directors were required for the initial setup of the Foundation.

The initial directors of the ME Foundation are:

- Matt Szenics: 10+ years of experience in finance, capital raising and corporate development. Previously an investment banker, corporate development leader, and led various operating roles at Magic Eden - including BizOps & Strategy, BD and Finance.

- Terence Choo: Terence is a seasoned professional with comprehensive expertise in sales, trading, over-the-counter (OTC) dealing, and business development. He possesses extensive experience across multiple asset classes, including cryptocurrencies, commodities, and equities, and has been actively engaged in the cryptocurrency sector for over five years.

- Matthew Shaw: Founder of Webslinger Advisors with extensive experience in mainstream finance, having been an investment banker for over 25 years. He has been deeply involved in crypto since 2017 and has a wide range of web3 advisory mandates.

As outlined in the Foundation's governing documents, the ME DAO has significant authority over the directors. It can remove or elect the ME Foundation's directors or change the number of directors at any time through a Foundation MIP, provided that the ME Foundation must have at least 1 director at all times.

2. Initial Setup Costs of the ME Foundation and ME DAO and Initial Operating Funds

The ME Foundation incurred pre-launch costs to set up the ME DAO and its governance. The work involved careful consideration and guidance on legal structures, technical expertise, and development. This effort was aimed at providing a safe, legal, and technical framework for the DAO to self-govern on a trusted platform.

Prior to launch over the course of a year, in total $1.4 million was used to fund the following expenses:

- Legal costs

- DAO administration setup and registration fees

- Near-term operating costs & contractors

- Contracts with third party vendors

The ME Foundation has additionally allocated a reserve of tokens within the Foundation Treasury for ecosystem partners. More details are included in Appendix A.

3. DAO Governance

The governance structure was established in line with The Constitution of the ME DAO.

3.1 Relevant Platforms:

- https://github.com/me-foundation/mip - is the forum for governance discussions where Tokenholders can propose, comment on and submit MIPs for review.

- https://mefoundation.com/proposals - on-chain governance platform utilized for voting on proposals submitted by the DAO Administrator.

3.2 Governance Power breakdown

$ME Tokenholders

$ME tokenholders, who constitute the ME DAO, play the most critical role in the proper functioning of decentralized governance, pursuing a trustless, transparent, and verifiable ME ecosystem. As the ME network is intended to be a public good, governance over it should be directed by those it serves.

$ME tokenholders can directly propose, vote on, and implement on-chain MIPs regarding the ME network.

Security Council

The Security Council is a committee of 5 members of a multi-sig wallet with the ability to perform both Emergency and Non-Emergency Actions, as detailed in the ME DAO Constitution.

The Security Council needed to be operational at the DAO's launch, as they would be required to mobilize in cases where a critical vulnerability significantly compromises the integrity or availability of a chain governed by the ME DAO or to ensure that any actions of the DAO comply with the Constitution's rules.

The initial Security Council members are:

- 2y2uu6BnNPzXfx4X2ji42VCArkwdr9wm7SmGkMsPWWWA: Co-Founder/CTO of Magic Eden

- C2q2Z4kmdfutmBYYqA5Bu6bHmbr2E77zk2k91YYEwsQf: Co-Founder/Chief Engineer of Magic Eden

- EsmFrjZuXg6SMQu78QWSM4DWxYQCj86r4zeFRhvb4S1z: Director at ME Foundation

- D9on7nU5rmANsXSfa7a9YAU2n54VjAxdPKitpxtvwFQs: Full-time technology investor and independent advisor

- FoSGKYHTLjL5RzAujxSu356SeUE65VJ2j5TH9buUy2Ze: Co-Founder/CTO of infrastructure technology company

For additional information regarding ME DAO governance procedures please visit the ME Foundation Governance Page

Appendix A Token Allocation:

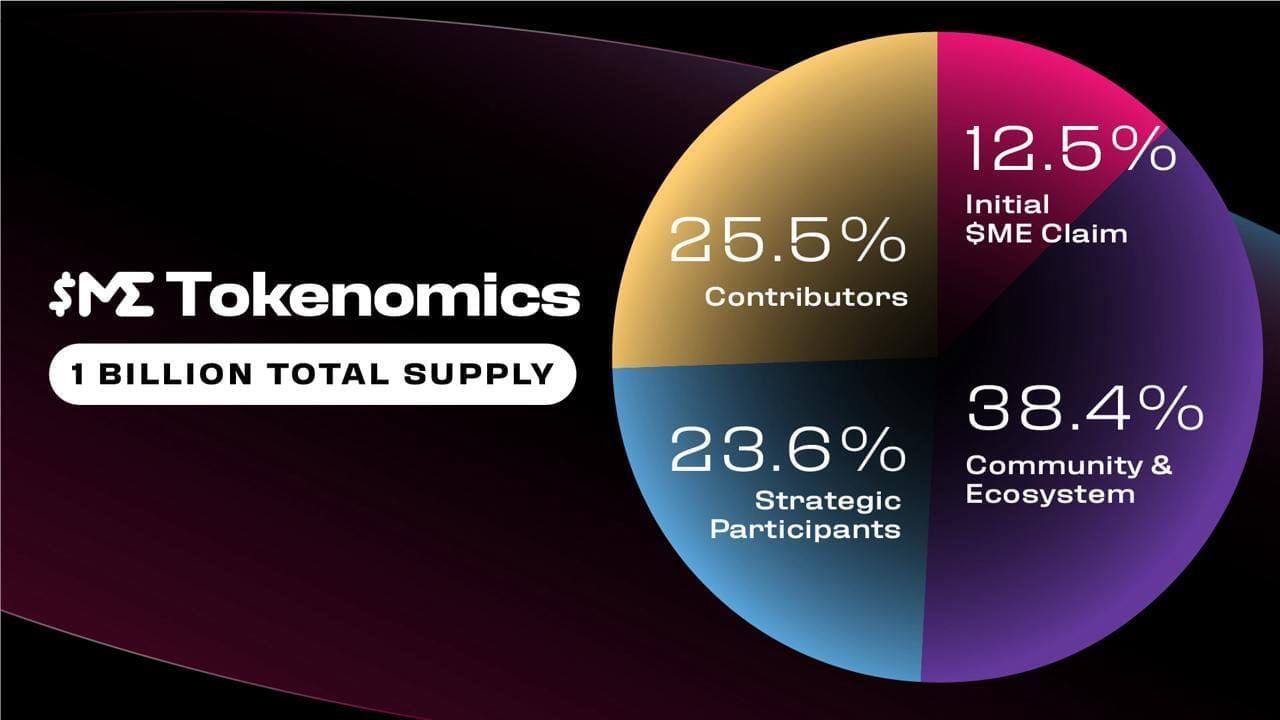

Update to tokenomics: We have added additional details on tokenomics below to complement this transparency report. One change from the initial tokenomics report is that the Community & Ecosystem allocation increased by 0.7%. The increase came from amounts originally earmarked for Contributors decreasing. The new total for Community (Initial Claim + Community & Ecosystem) is 50.9% vs 50.2% in the initial tokenomics report.

Initial $ME Claim at TGE: 12.5%

- This claim went to users across Bitcoin, Solana, and EVM ecosystems who form an integral part of $ME DAO. This allocation was fully unlocked at TGE and distributed to users via Magic Eden’s mobile dApp.

- Any amounts that are left unclaimed will go back to $ME stakers as future rewards as part of the Community allocation.

Community & Ecosystem: 38.4%

- The majority (22.5%) has been reserved to reward active users of ME protocols, to be released primarily via Magic Eden’s rewards program. These tokens will be unlocked linearly over a period of 4 years.

- The remaining (15.9%) of this allocation will go towards Ecosystem Development, including passionate advocates who want to grow and support the protocols. These grants will be structured as long-term agreements to align long term stakeholders in the ecosystem.

- 5% of Ecosystem Development is allocated to the Foundation Treasury. This amount was partially unlocked at TGE, and will not enter into circulation unless necessary.

- Over the last 6 months until the date of this report, ME Foundation has allocated 0.72% of the Foundation Treasury to ecosystem partners to make specific contributions to the development and adoption of ME protocols, drive awareness, promote the use of the protocols, and reward users of the protocols. This also includes loans to third parties denominated in $ME. To date, 0.47% of this allocation has entered circulation, and the remainder has not been unlocked. See Appendix B for more information.

Contributors: 25.5%

- This allocation is for past, present and future contributors of ME protocols and ME DAO, including advisors, contractors and Magic Eden employees.

- Core contributors representing >60% of the Contributor allocation are locked for a minimum of 18 months post-TGE.

- All current and future contributors are locked for a minimum period of 12 months post-TGE.

- Altogether, core contributors, current and future contributors who are locked for at least 12 to 18 months post TGE represent more than 99.5% of the total contributor allocation

- A small percentage of this allocation for early contributors and advisors, approximately 0.1% of total supply, will be unlocked three months post-TGE.

Strategic Participants: 23.6%

- All strategic participants who have provided critical guidance in the development of the ME protocols will have a minimum lockup period of 12 months post-TGE and follow the Token Emissions Schedule for gradual unlocking.

Appendix B Treasury Information:

Community Token Distribution

*All tokens that are earmarked for contributors and strategic participants are not included in the ME figures above.